What Is The 2025 Medicare Deductible. In 2025, the medicare part b deductible will most likely see an increase from the previous year’s $240, mainly due to projected healthcare spending. In 2025, the annual deductible for medicare part d will increase from $545 to $590, a $45 rise.

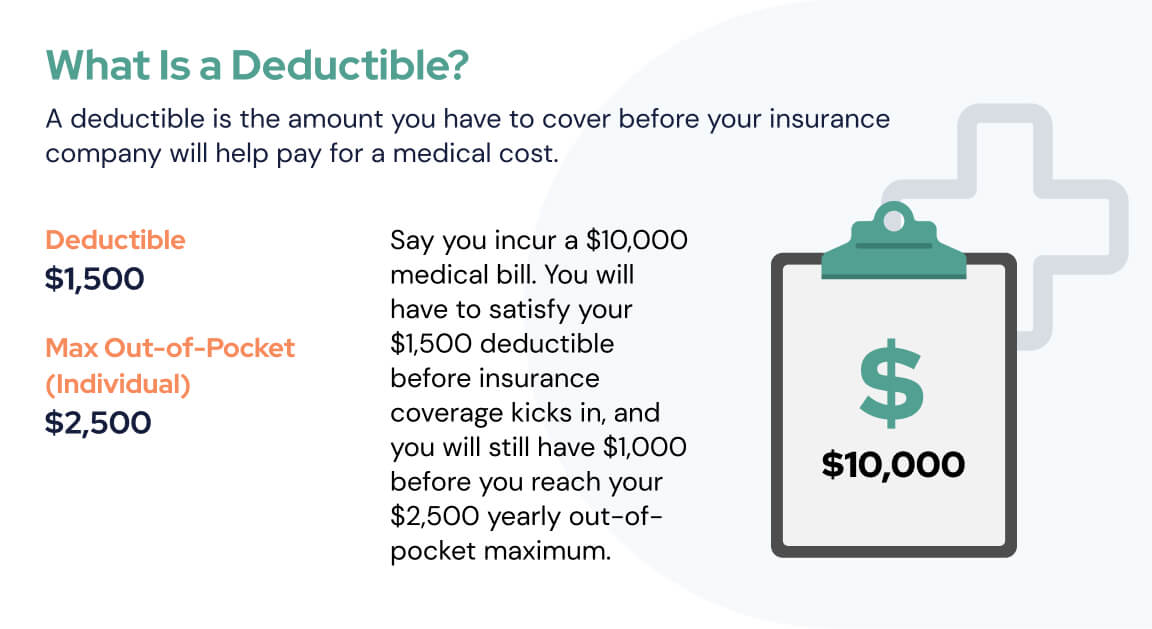

During the deductible phase, part d enrollees are responsible for 100% of their drug costs, up to a maximum of $505 in 2023. Starting january 1, 2025, the structure of the medicare part d benefit will be significantly updated.

Part D Annual Deductible Changes.

The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2023.

The Standard Initial Deductible Will Decrease From $545 In 2025 To $590 In 2025.

Now is the time to check your 2023 tax return to see if you might be.

What Is The 2025 Medicare Deductible Images References :

Source: www.slideserve.com

Source: www.slideserve.com

PPT What Is the Medicare Deductible PowerPoint Presentation, free, In 2025, the government will increase the compensation for initial enrollments in medicare advantage and part d plans by $100—more than three times higher than cms initially. Medicare advantage plan costs in 2025.

Source: clearmatchmedicare.com

Source: clearmatchmedicare.com

Medicare Deductibles ClearMatch Medicare, Only time will tell exactly what changes will be prominent among medicare advantage plans in 2025. Rebates to medicare advantage plans have more than doubled since 2018 and now exceed $2,000 per year per beneficiary.

Source: www.vrogue.co

Source: www.vrogue.co

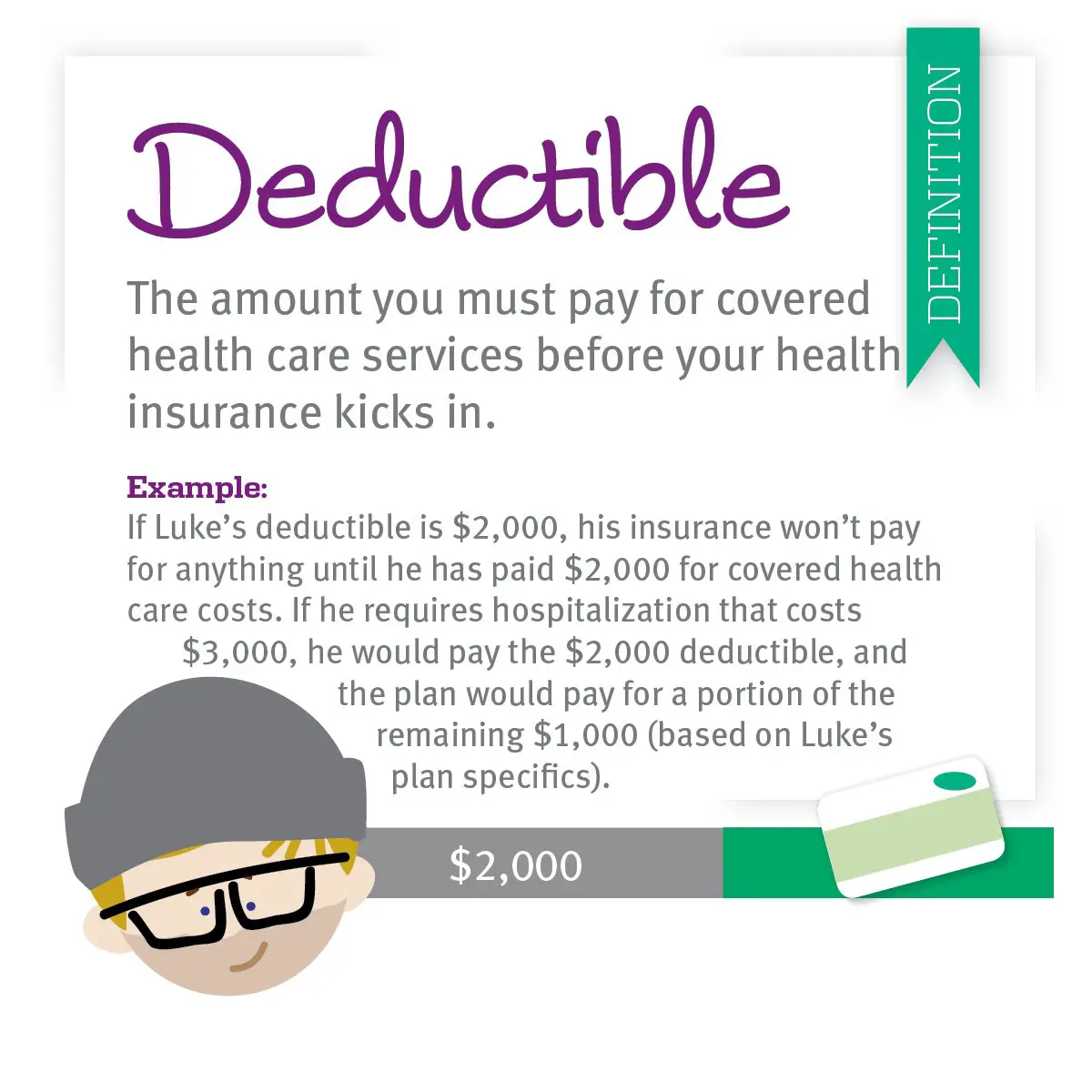

Your Guide To Understanding Your Deductible Mibluespe vrogue.co, 01 = deductible 04 = amount reported from previous payer as. Only time will tell exactly what changes will be prominent among medicare advantage plans in 2025.

Source: matildawlynn.pages.dev

Source: matildawlynn.pages.dev

Medicare Part B Deductible 2025 Amount Chart Austin Florencia, This means that part d sponsors can’t set a. On april 4, 2025, the centers for medicare & medicaid services (cms) issued a final rule that revises the medicare advantage program, medicare prescription drug benefit.

Source: dgalcorn.com

Source: dgalcorn.com

Medicare Prescription Drug Plan Deductible How Does It Work? DG, There will be no change of payment responsibility in the. 01 = deductible 04 = amount reported from previous payer as.

Source: www.medicaretalk.net

Source: www.medicaretalk.net

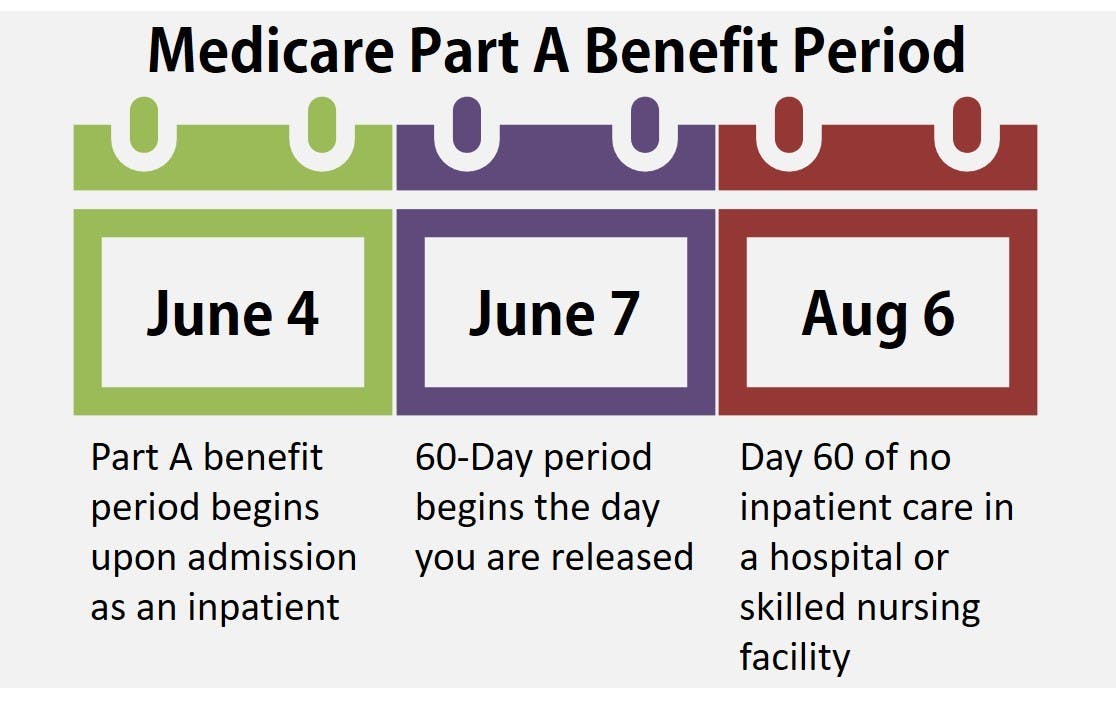

What Is My Deductible For Medicare, $1,632 for each inpatient hospital benefit period , before original medicare starts to pay. However, once the amount is available, we will provide that information here.

:max_bytes(150000):strip_icc()/medicare-part-d-eligibility-4589763-1670217de0f843d5a368218e33b28067.png) Source: medicare-faqs.com

Source: medicare-faqs.com

What Is Deductable For Medicare Part B, Only time will tell exactly what changes will be prominent among medicare advantage plans in 2025. The standard initial deductible will decrease from $545 in 2025 to $590 in 2025.

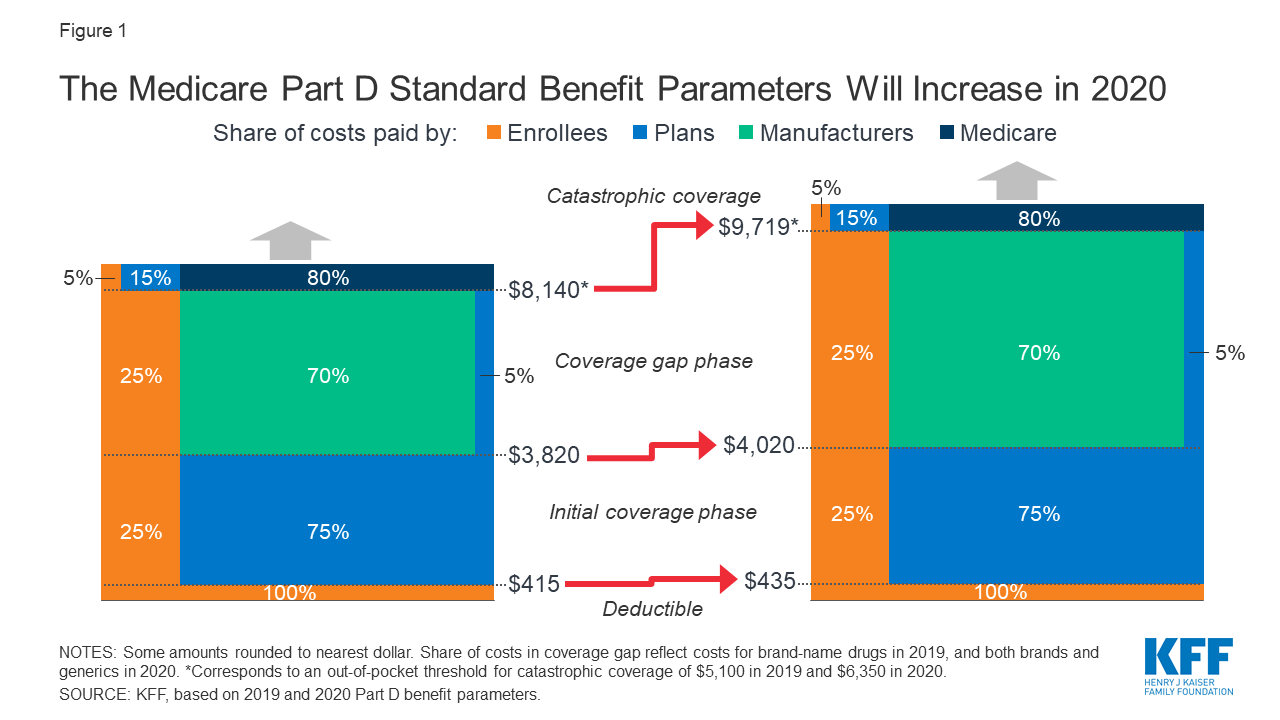

Source: www.kff.org

Source: www.kff.org

How Will The Medicare Part D Benefit Change Under Current Law and, On april 4, 2025, the centers for medicare & medicaid services (cms) issued a final rule that revises the medicare advantage program, medicare prescription drug benefit. Beneficiary cost updates for 2025 1.

Source: www.retireguide.com

Source: www.retireguide.com

Medicare Part A & B Deductibles in 2023, The annual part b deductible increased by $14 to $240. The standard initial deductible will decrease from $545 in 2025 to $590 in 2025.

Source: www.medicarefaq.com

Source: www.medicarefaq.com

Medicare Part D Coverage Phases, Deductible & Premium MedicareFAQ, The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2023. This means that part d sponsors can’t set a.

In 2025, The Government Will Increase The Compensation For Initial Enrollments In Medicare Advantage And Part D Plans By $100—More Than Three Times Higher Than Cms Initially.

However, once the amount is available, we will provide that information here.

The Annual Deductible Will Rise From $545 To $590 — A $45 Increase — In 2025.

$1,632 for each inpatient hospital benefit period , before original medicare starts to pay.

Category: 2025